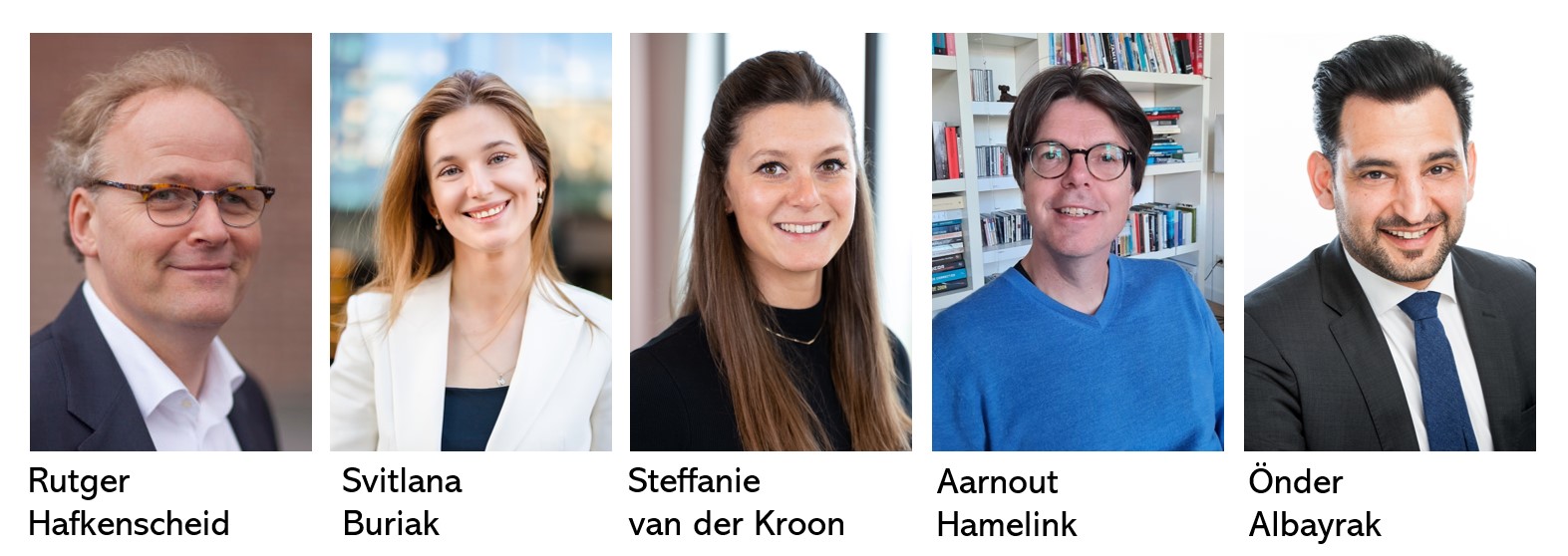

Lecturers

Rutger Hafkenscheid

Rutger Hafkenscheid is a Partner at Huygens Quantitative Consulting (Amsterdam). Rutger serves a wide range of clients, domestic and international, in real estate, private equity and other industries. He specialises in the quantification of risks and rewards in all aspects of corporate taxation and transfer pricing, from business restructurings to financial transactions, including loan financing, derivatives, and captive insurance. Rutger developed a methodology for the valuation of uncertain tax claims in litigation.

Rutger received his degree in tax law from the Rijksuniversiteit Groningen in 1987. After having served a few years as a counsel to one of the political parties in Dutch Parliament, he started his career as a tax advisor with one of (then) Big Eight accounting firms. In 1995, he continued his career with Arthur Andersen, where he was made partner in 1998. Between 2002 and 2009, Rutger was a tax partner with Deloitte in Amsterdam, where he was Community Head from 2006 to 2008. From 2013 onwards, he worked as a counsel in the transfer pricing and economics practice of Loyens & Loeff. Rutger lectures transfer pricing as a visiting lecturer at the University of Amsterdam and frequently publishes about tax and transfer pricing in Dutch and international journals.

Dr. Svitlana Buriak

Svitlana Buriak is an Ass. Professor at the University of Amsterdam and Director of the Amsterdam Center for Transfer Pricing and Income Allocation. She successfully defended her doctoral dissertation in Business Tax Law at the Vienna University of Economics and Business.

She is also a tax adviser at Loyens & Loeff (Amsterdam Office). Svitlana specialises in international and European tax law, and transfer pricing. Svitlana advises clients on matters such as IP structures, business restructurings, intra-group financial transactions, implications of OECD Pillar II, transfer pricing and state aid, etc. Svitlana is an author of many articles published in peer-reviewed journals and book contributions, as well as an active speaker at academic and professional conferences and events.

Steffanie van der Kroon

Steffanie van der Kroon is a tax adviser at Loyens & Loeff (Amsterdam Office). She advises multinationals on international tax law, with a focus on transfer pricing. Steffanie specialises in Dutch corporate tax issues in international structuring and restructuring.

She is further involved in a broad range of transfer pricing related issues, such as the implementation and evaluation of transfer pricing systems, obtaining advance pricing agreements, assisting with business restructurings and value chain analyses as well as the preparation of the required transfer pricing documentation.

Aarnout Hamelink

Aarnout Hamelink was educated as an accountant and tax expert and has broad and deep experience within the Tax Administration in corporate income tax, with a focus on transfer pricing. Positions Aarnout has held include income tax and corporate income tax specialist in the SME segment, corporate income tax specialist and client coordinator with focus area large enterprises, secretary of the Transfer Pricing Coordination Group, content manager of the APA team, negotiator on behalf of the Tax Administration in many Multilateral Agreement Procedures and Bilateral Advance Pricing Agreements and Technical Advisor Corporate Income Tax of a unit in which the construction, trade and industry sectors are represented in the large enterprises segment.

Aarnout takes noticeable pleasure in providing professional guidance to individuals and groups and has extensive experience in this too within and outside the Tax Administration.

Önder Albayrak

Önder Albayrak is the Head of Transfer Pricing within the Tax Strategy & Operations team of Sanofi, a global biopharmaceutical company providing healthcare solutions in more than 170 countries. Following his career at a Big4 firm, he moved in 2006 to industry to work at Genzyme a NASDAQ-listed biotechnology company which got acquired in 2011 by a Sanofi where he pursued his career in various regional and global corporate tax and transfer pricing roles.

During his twenty+ years of experience in international taxation, he advised and supported corporate, regional and local management, operations, finance and legal teams on international corporate taxation and transfer pricing matters such as intangible assets planning, supply chain and transfer pricing structuring, business expansions and restructurings, post-merger integrations, tax and transfer pricing controversy, negotiations with tax administrations and tax policy matters. Önder Albayrak holds an LL.M. in Dutch and International Tax Law from the University of Utrecht, the Netherlands and appears from time to time as guest speaker and lecturer at conferences and courses.

Transfer Pricing Executive Course – Business Simulation 11-15 September 2023

Registration website for Transfer Pricing Executive Course – Business Simulation 11-15 September 2023

Registration website for Transfer Pricing Executive Course – Business Simulation 11-15 September 2023Wendy Rademaker-Swartactp-taxlaw@uva.nl

Wendy Rademaker-Swartactp-taxlaw@uva.nlhttps://www.aanmelder.nl/tpcourse

2023-09-11

2023-09-11

OfflineEventAttendanceMode

EventScheduled

Transfer Pricing Executive Course – Business Simulation 11-15 September 2023Transfer Pricing Executive Course – Business Simulation 11-15 September 20230.00EUROnlineOnly2019-01-01T00:00:00Z

Transfer Pricing Business Simulation Course Transfer Pricing Business Simulation Course Oude Turfmarkt 127-129 1012 GC Amsterdam Netherlands